Fragrances

U.S. Beauty Industry Thrives Ahead of Holiday Season, Circana Reports

As the holiday season approaches, the U.S. beauty industry continues to experience significant growth, with both prestige and mass market beauty segments seeing an increase in sales. According to Circana’s latest data, the U.S. prestige beauty market grew by 7%, reaching $22.8 billion, while mass market sales rose by 2% compared to the same period last year.

This growth comes amid a more optimistic outlook for the holiday shopping season, with U.S. consumers planning to spend 2% more on gifts compared to 2023, driven by expectations of the best holiday deals in four years. Circana’s 2024 Holiday Purchase Intentions Report highlights a positive shift in consumer sentiment, particularly among higher-income households, with prestige beauty being seen as a key indicator of consumer confidence.

Larissa Jensen, global beauty industry advisor at Circana, noted, “Prestige beauty epitomizes the indulgence in little luxuries and acts as an indicator of the consumer mindset for the beauty industry overall.” As part of this trend, 29% of shoppers plan to purchase beauty products as gifts this year, a slight increase from 2023, with households with children showing a particularly high interest.

Growth in Key Beauty Segments

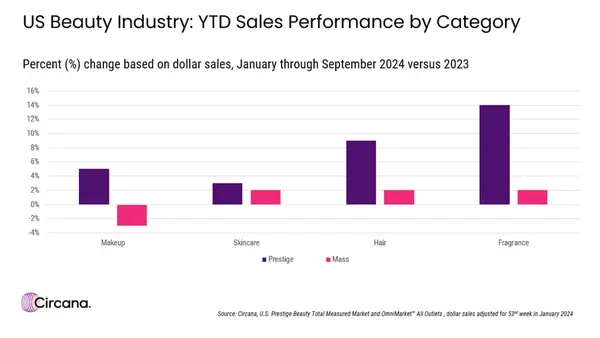

Makeup continues to dominate the prestige beauty category, with a 5% increase in both dollars and units sold. The lip segment saw impressive growth, with 21% more in dollar sales and 23% more in units sold. This surge is largely attributed to the growing popularity of tinted lip balms and oils.

Fragrance is the fastest-growing category of 2024, with sales up 14% in dollars and 12% in units. Smaller-sized women’s fragrances have been particularly successful, with sizes under 1 oz growing four times faster than other sizes. The holiday season is expected to be a major driver for both prestige and mass market fragrance sales, traditionally contributing over 40% of annual sales.

In skincare, mid-range brands are outpacing prestige products, with growth driven by more affordable options in department stores and beauty specialty stores. Meanwhile, prestige haircare continues to perform strongly, with 8% growth in dollar sales and the hair wellness segment driving notable increases.

Circana’s report also indicates that e-commerce remains a significant channel for beauty sales, especially within the haircare market, with over half of sales in department stores and specialty stores coming from online shopping. As the holiday season kicks off, online shopping is expected to be particularly lucrative, especially for haircare gifts.